Stop writing off bad debts and instead, get your checks.

“Do you have anything to make collections easier?”

If you are writing off too much bad debt, it’s probably time to either 86 a customer, or put some muscle into your collections process. It does not have to be agonizing. And when you manage collections letters through CRM, it makes those communications transparent to your internal staff.

Think of how that’s helpful- for example…as a heads up for a salesperson who is about to make a visit to an overdue customer?

Here’s how to do this with a nice combination of Sage CRM, Sage 300 ERP, and Accelerator by CRM Together.

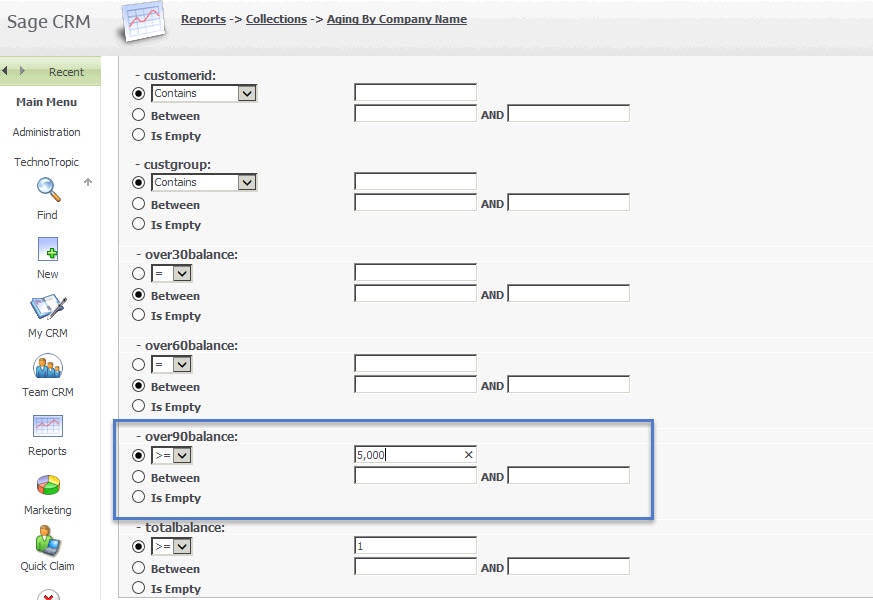

Step 1: Who is overdue?

Do not let this process be random and reactive! In order for this to work, you need to cut through the noise and prioritize your most overdue customers. We’ll build you a report, run through CRM, that shows you all the overdue aging balances and gives you the tools to only see what you need to see. For example, you could pull up everyone who has owed $5,000 or more for 90 days.

Start there.

This report is auto-hyperlinked. Start at the top, click the name, and you are delivered to that record in CRM.

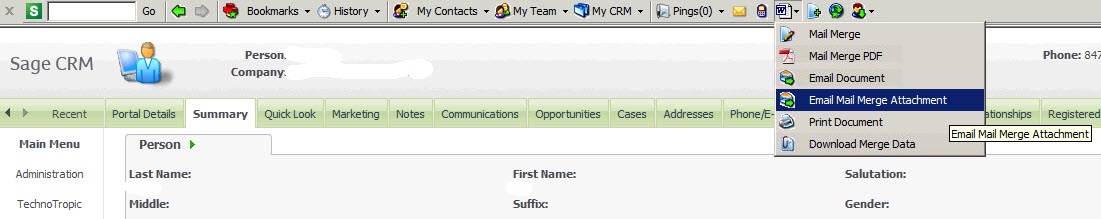

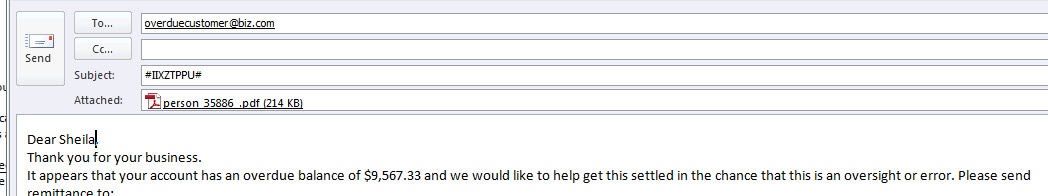

Step 2: Contact them.

Now, use the Accelerator IE toolbar to initiate a mail merged letter, and have it automatically attach to an email. This is one of the biggest time savers in this process.

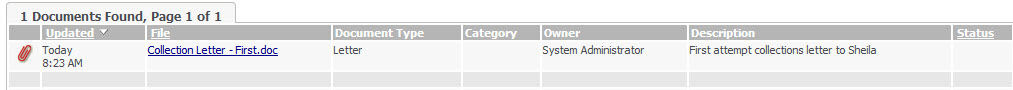

Step 3: Do nothing and let CRM file the letter for you. 🙂

After you send the email, since you’ve done this all within the context of CRM, it is saved as a collections letter in that record.

This is one of the better ways to both keep track of collections letters for yourself and provide a way for other people who work with that customer to be aware of where you are in the collections process.

If you know your collections process needs to improve, just ring up Arline at 773-346-7009 and we’ll have this running for you in no time.